exclusive tax and service charge

Where any payment for goods or service mentions price exclusive of tax it clearly means that the amount mentioned would be increased by the amount of taxes payable. To calculate GST and Service Charge based on subtotal.

Tax Inclusive Vs Tax Exclusive What S The Difference

For example a household that earns 130 and pays 30 in.

. If you are being blocked from reading Subscriber Exclusive content first confirm you are logged in using the account with which you subscribed. At a rate of 1 percent the difference is negligible but a 50 percent tax-exclusive rate corresponds to a 33 percent tax-inclusive rate which is a big difference. And there is no separate charge for the service.

All Fees Exclusive of Taxes. Inclusive price 25 FB Tax 98 service charge 22 sales tax on. If the tax amount is 10.

Answer 1 of 4. Sales tax is not due on the 43 charge for the alterations since the charge was. October 17 2022 Today United States Attorney Sandra J.

Support quality local journalism. Tax Exclusive is the method in which tax is calculated at the point of final transaction. A merchant may charge 10000 for a service plus tax.

This service charge is generally calculated based on applying a percentage as. About Exclusive Tax Service. Sales tax is computed on the 300 charge for the suit only.

Offer valid for tax preparation fees for new clients only. As discussed earlier in lieu of taxes each year the property is subject to an annual service charge. Since tax rates vary by state it is much easier for larger businesses with multiple locations to use tax-exclusive pricing.

A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax. If a price is inclusiveof postage and packing it includes the charge for this. Newsroomciirsgov Louisville KY A Louisville attorney was sentenced today to 27 months in prison and was ordered to pay a 15000 fine.

Dorsey announced that a Montgomery tax preparer was sentenced for aiding and assisting in the preparation of a false income tax return. Sales tax rates are typically quoted in tax-exclusive terms but income tax rates are typically quoted as tax inclusive. 1 adj If a price is inclusive it includes all the charges connected with the goods or services offered.

Subject to 125 minimum charge. Exclusive Charges means the sum of the charges for the Exclusive Station Services as such charges are specified in Schedule 2 subject to such variations as satisfy both the following. Bennett of the Western District of Kentucky and Bryant Jackson Special Agent in Charge of the Internal Revenue Service Criminal Investigation Cincinnati Field Office.

Stewart and Internal Revenue Service IRS Criminal Investigation Special Agent in Charge James E. Subject to Section 4 D all Fees payable to Licensor under this Agreement are exclusive of any taxes including but not limited to any. GST Calculator Service Charge Calculator.

1 day agoIn total the Secret Service spent at least 14 million in tax dollars at Trump Organization hotels and other properties over 669 expenditures between January 2017 and September 2021 House. We have been providing individuals and businesses with expert financial and tax advice for over 20 years. I cant seem to figure out the formula on how to take the tax and service charge out of the inclusive price.

What Does Tax Inclusive Mean. On Friday October 14 2022 Lashunda Deann. 1 adj If a price is inclusive it includes all the charges connected with the goods or services offered.

Hence in the above example if the tax-inclusive rate of. A merchant may charge 10000 for a service plus tax. Tax-inclusive as the name suggests refers to that tax which is inclusive of the value of total purchase done by the consumer.

We have an Investment Committee that brings. October 18 2022 Contact.

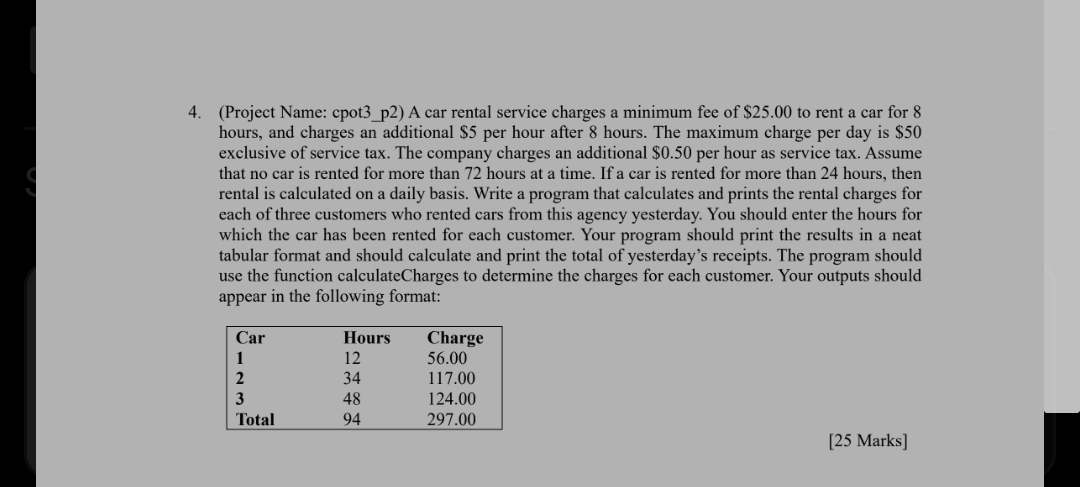

Solved 4 Project Name Cpot3 P2 A Car Rental Service Chegg Com

Hilton Conrad Waldorf Astoria Lxr Daily F B Credit Offers Loyaltylobby

What Services Are Subject To Sales Tax In Florida

Tax Inclusive Vs Tax Exclusive What S The Difference

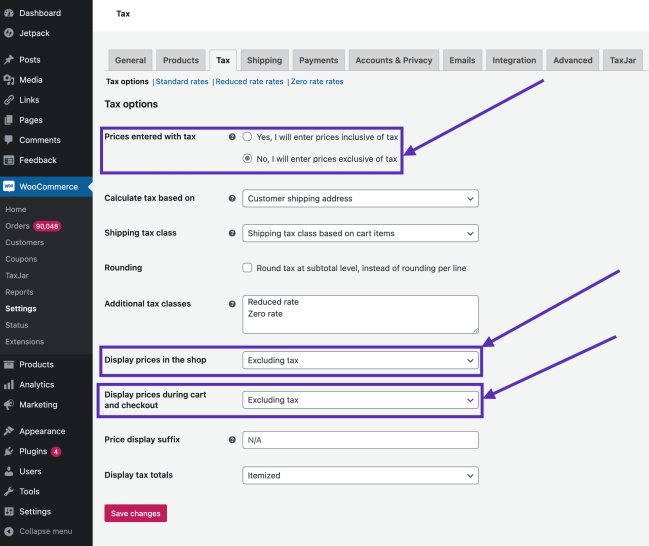

Setting Up Taxes In Woocommerce Woocommerce

Tax Examples By Country Rms Help Centre

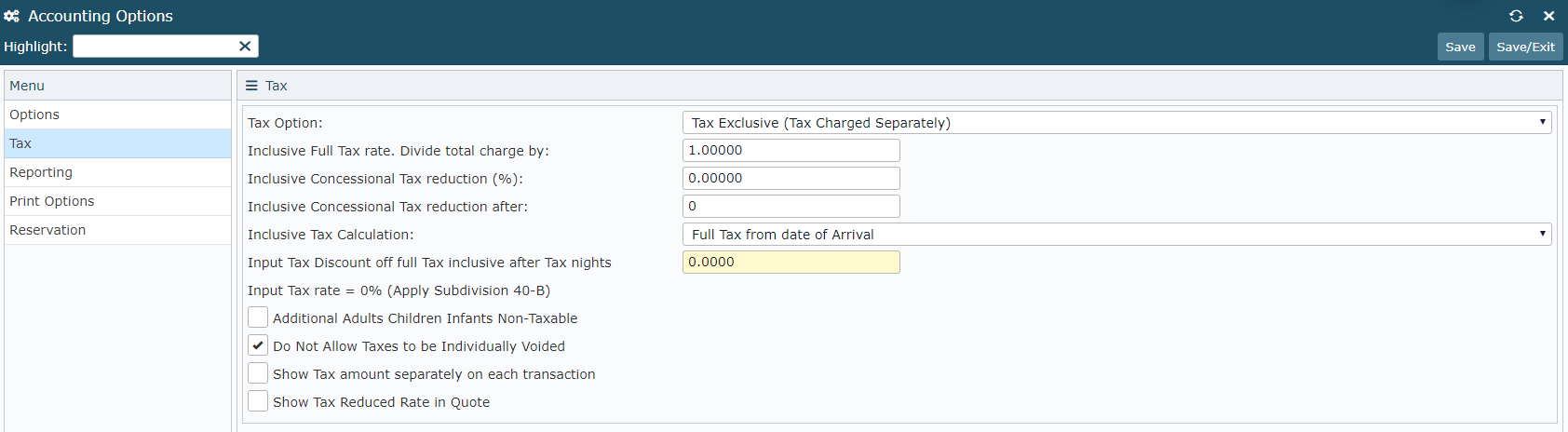

Booking Engine Create And Manage Taxes

Ifc Post Exclusive Tax As Itemizer Application Setting

Exclusive Tax Service Exclusive Tax Services

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy

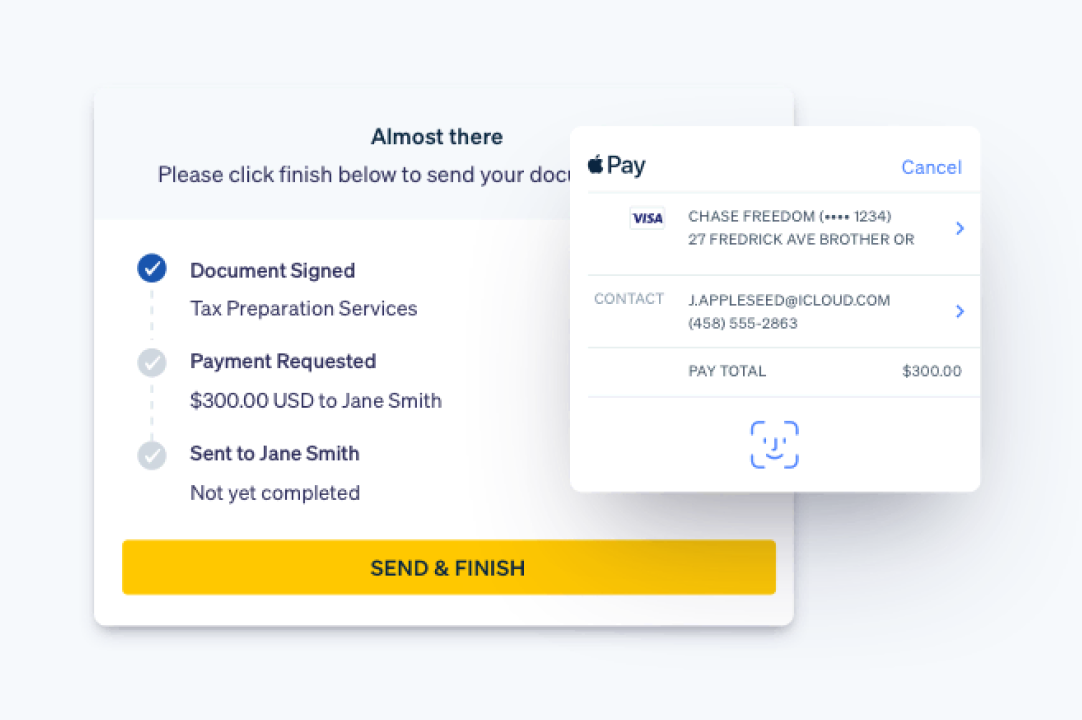

Introduction To Monetizing Payments For Saas Platforms

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy

Ifc Post Exclusive Tax As Itemizer Application Setting