reit dividend tax rate 2021

Singapore Dividend Withholding Tax. Geo Overview Real Estate.

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that.

. However this percentage may be higher or lower than the real cost of capital. REITs and Capital Gains Taxes. Whitestone REIT and Subsidiaries.

This gives you a total income of 32570. 4What is the 2021 Withholding Tax Rate for REITs. 5Is there anyway to get a reduced Withholding Tax Rate.

These ordinary dividends are taxed alongside your remaining income at the tax rate for which your overall income qualifies. Reit dividend tax rate 2021 Thursday March 17 2022 Edit. CONSOLIDATED BALANCE SHEETS in thousands except share and per share data March 31 2022.

The tax rates for non-qualified dividends are the same as. Your 2021 Tax Bracket to See Whats Been Adjusted. PLYM announced the tax treatment of its 2021 dividends to common stockholders.

The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders. NasdaqCTRE today reported operating results for the quarter ended March 31 2022 as well. And the shareholders are subjected to tax on the dividends irrespective of the rate of tax paid by the company.

For single filers if your 2021 taxable income was 40400 or less or 80800 or less for married couples filing jointly then you wont owe any income tax on dividends earned. You have a Personal Allowance of 12570. Discover Helpful Information and Resources on Taxes From AARP.

Turkey reduces withholding tax rate on dividend distributions to 10. This provision qualified business income effectively lowers the federal tax rate on ordinary REIT dividends from 37 to 296 for a taxpayer in the highest bracket. 710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest.

The tax rate on nonqualified dividends is the same as your regular. Turkey reduces withholding tax rate on dividend distributions to 10. PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder.

25 May 2021. The tax rate on nonqualified dividends is the same as your regular income tax bracket. You get 3000 in dividends and earn 29570 in wages in the 2021 to 2022 tax year.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. 915 tax rate if shareholder owns more than 50 of the REITs voting stock. Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen.

Take this off your. The remaining 060 comes. In general REITs pay out approximately 90 percent of net income annually to shareholders.

Your dividends would then be taxed at 15 while the rest of your income would follow the federal income tax rates. SAN CLEMENTE Calif May 05 2022 GLOBE NEWSWIRE -- CareTrust REIT Inc. Of this 120 of the dividend comes from earnings.

A ReitInvIT can therefore. BOSTON January 18 2022 -- BUSINESS WIRE --Plymouth Industrial REIT Inc. Ad Compare Your 2022 Tax Bracket vs.

830 tax rate if. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status.

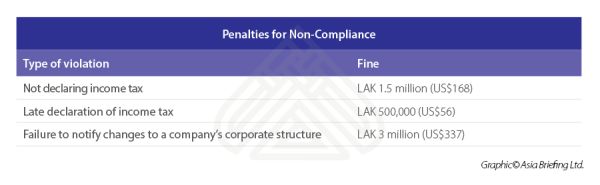

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

Secret Tax Hacks Money Management Investment Quotes Real Estate Investor

Sec 199a And Subchapter M Rics Vs Reits

Dividend Tax Rates In 2021 And 2022 The Motley Fool

What You Need To Know About Capital Gains Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Biden Tax Plan And 2020 Year End Planning Opportunities

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

Effective Tax Rate Formula And Calculation Example

Dividend Tax 2021 22 Explained Raisin Uk

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

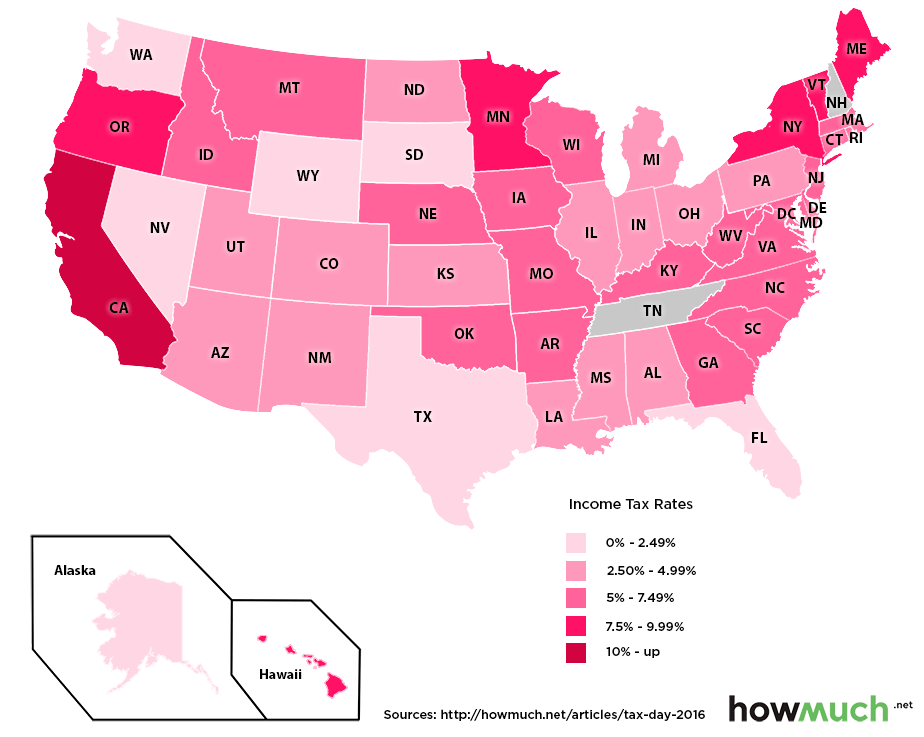

Which U S States Have The Lowest Income Taxes

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

Corporate Tax In The United States Wikiwand

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen